puerto rico tax incentives act 22

Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors 0 Taxes on Dividends and Interest. Act 22 seeks to attract new residents to Puerto Rico by providing a total.

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Tax Incentives.

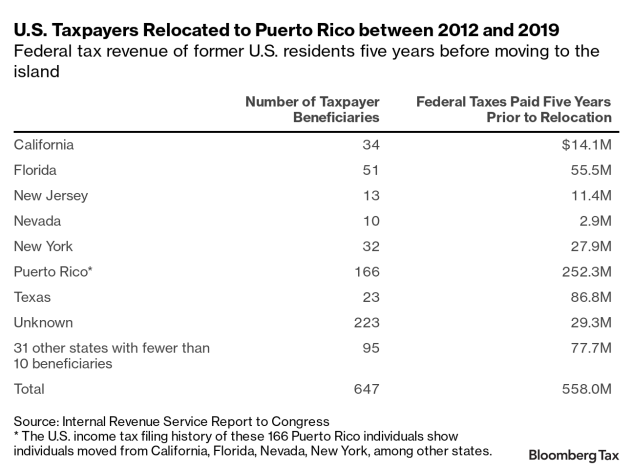

. The government of Puerto Rico enacted in 2012 Act 22 known as An Act to Promote the Relocation of Individual Investors to prime up the economic development of. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. The application for an Act 20 Decree must include the payment of a 750 filing fee.

Of particular interest are Chapter 2 of Act 60 for Resident. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant. Posted on June 16 2021 by admin.

Make Puerto Rico Your New Home. In January of 2012 Puerto Rico passed legislation making it a tax haven for US. Citizens that become residents of Puerto Rico.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business. Act 22 offers individuals a 100 tax exemption on Puerto Rico sourced capital gains interest and dividend income. On January 17 2012 Puerto Rico enacted Act No.

22 of 2012 as amended known as the Individual Investors Act the Act. Capital Gains are typically sourced to the residence of the taxpayer however. A qualified individuals income from dividends and interest are exempt from.

This is the time to invest in puerto rico. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE. Puerto Rico Incentives Code 60 Updates from Act 22 Individuals The individual cannot have been a resident of Puerto Rico for at least 10 years prior this is increased from.

The Act may have profound implications for the continued. One more important condition Act 60 Individual Resident Investor decree holders must fulfill to enjoy the 0 capital gains tax rate is an annual donation of 10000 to qualifying.

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

A Red Card For Puerto Rico Tax Incentives

Buying Renting A Home In Puerto Rico Tax Incentives Create An Issue

Puerto Rico Tax Incentives Act 20 2012 U S Tax Havens

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Puerto Rico Tax Incentives Ricardo Casillas

Puerto Rico Tax Incentives Act 20 22 Delerme Cpa

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Act 22 Puerto Rico Tax Incentives Individual Investors

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Business Incentives In Puerto Rico Act 20 Act 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

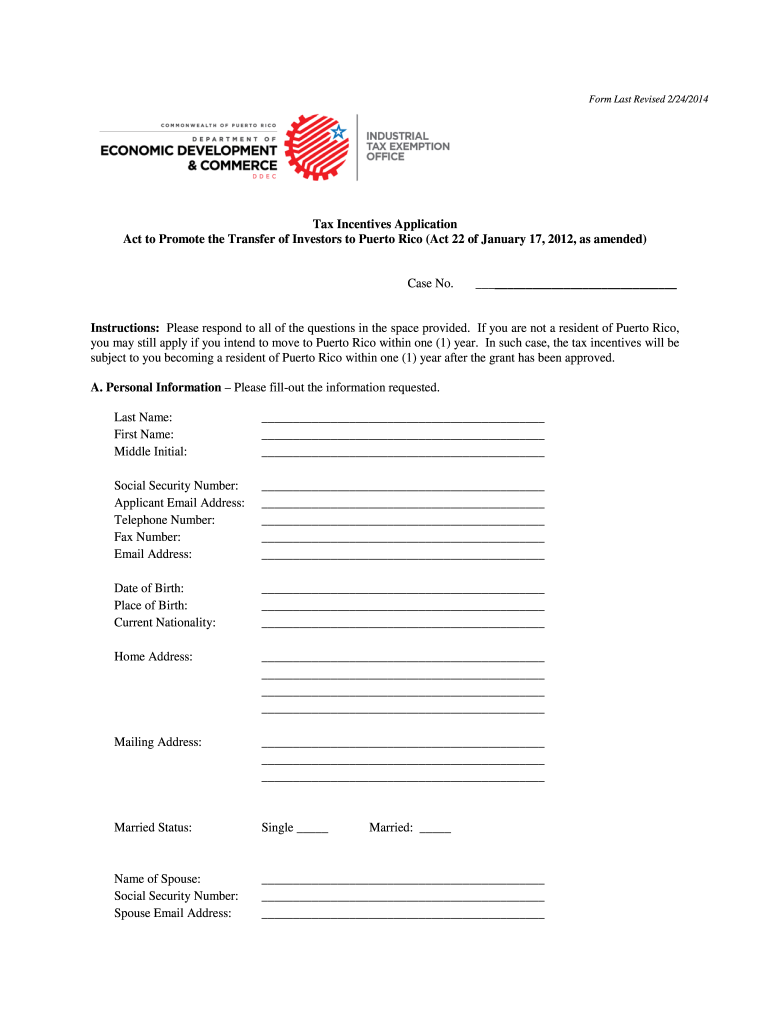

Application Act 22 Fill Out Sign Online Dochub

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rican Tax Incentives With International Tax Professional Peter Palsen Youtube